Understanding Volume

In the world of financial markets, trading volume is like the heartbeat that pumps life into assets, such as stocks, currencies, and commodities. It’s a fundamental concept in technical analysis that provides valuable insights into the strength and reliability of price trends.

What Is Trading Volume?

In the financial landscape, trading volume operates as the dynamic fuel powering market movements, akin to gas propelling a car. High volume roars with momentum, while low volume signals a potential slowdown. This metaphorical engine guides market turns, pauses, and accelerations, offering traders a gauge for navigating the ever-changing financial terrain.

Trading volume represents the total number of shares, contracts, or units of an asset traded within a specific time frame. This measurement reflects the level of interest and activity in a particular asset during a given period, such as a day, week, or even a minute. Here’s an expanded view of its significance:

Market Activity: Volume reflects the number of transactions taking place in the market. High trading volume indicates that many buyers and sellers are actively participating, making it a reliable sign of market activity and liquidity.

Market Sentiment: Volume can also provide insights into market sentiment. A surge in volume often accompanies significant events or news releases, which can influence market psychology. For example, a sudden spike in trading volume during an earnings report can signify investors’ reactions to the news.

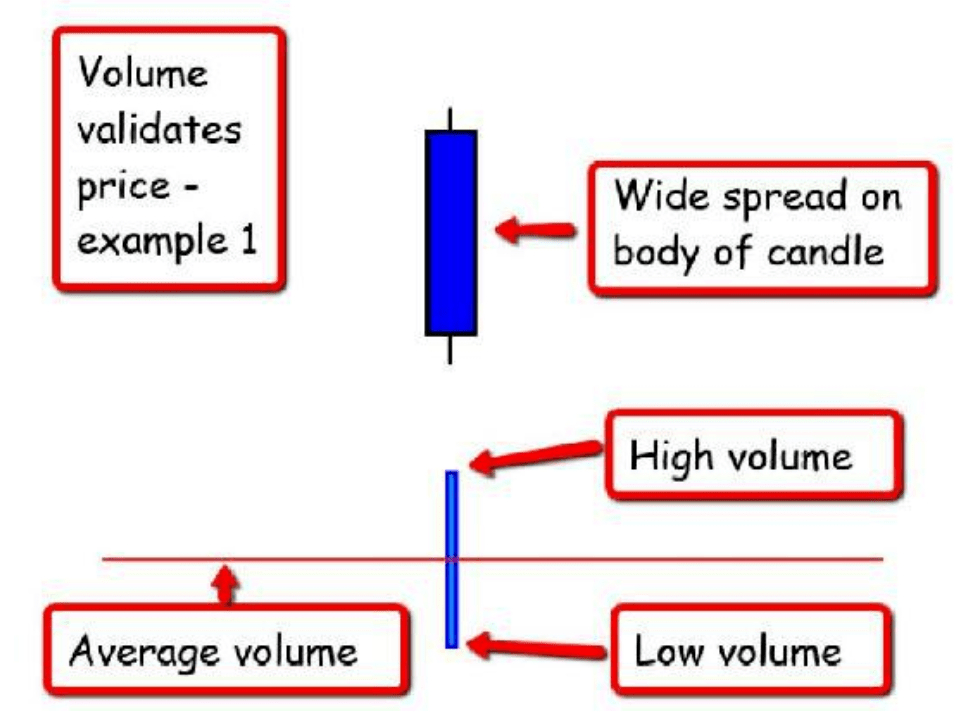

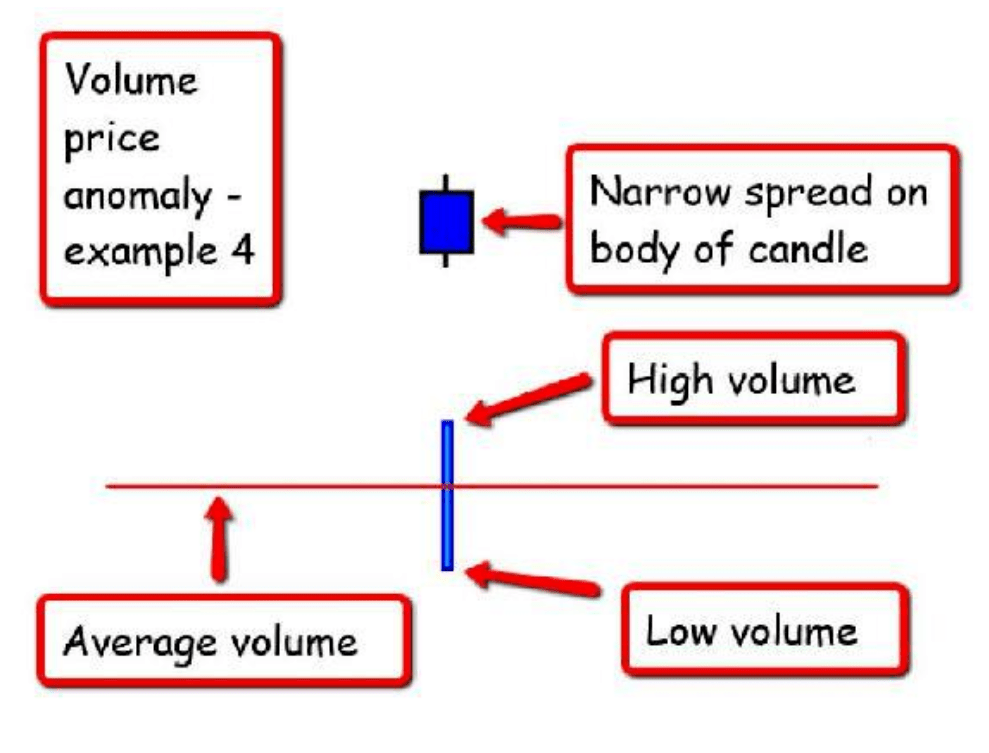

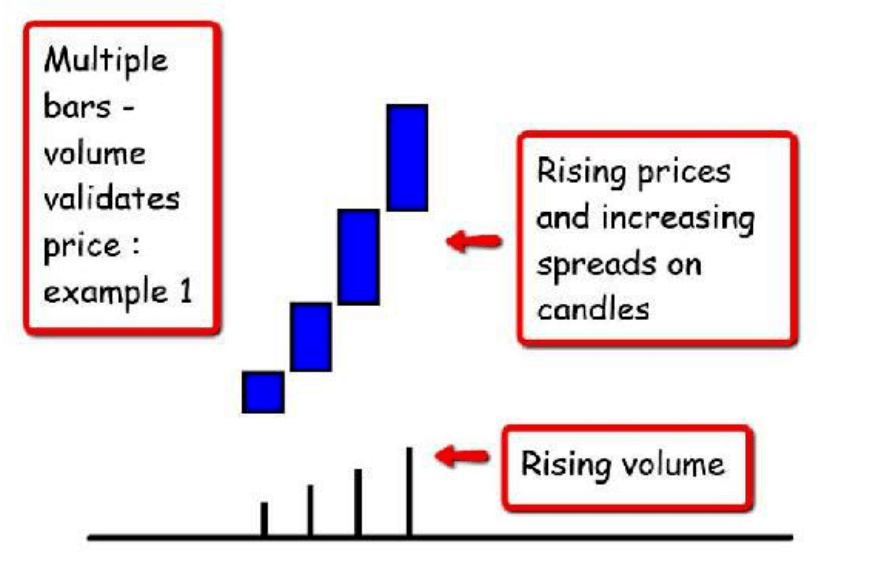

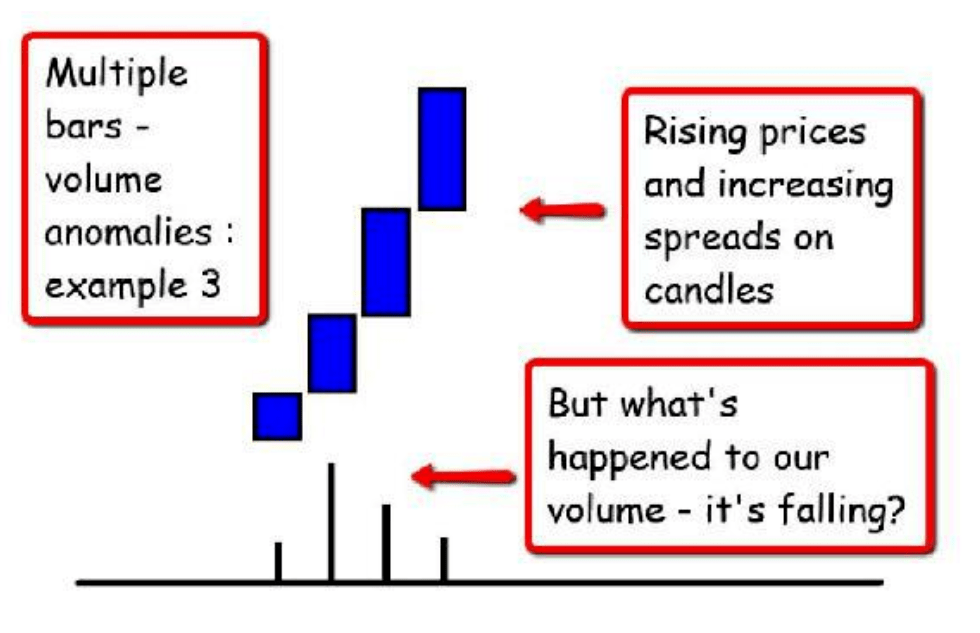

Confirmation of Trends: In conjunction with price movements, volume can confirm the strength of a trend. For example, in a rising market, increasing volume can validate the bullish trend by demonstrating strong buyer interest. Conversely, in a downtrend, rising volume can affirm the dominance of sellers.

Reversal Signals: Unusual or extreme volume spikes can act as an early warning sign for potential trend reversals. This means that a significant change in trading volume can precede a trend shift. For instance, a market bottom may be forming when trading volume suddenly surges after a prolonged downtrend.

EagleVision Cycle: Soaring through Market Currents

Embark on a journey with EagleVision cycle, where we harness the keen eyesight of eagles to decipher the intricate dance between price movements and trading volume. This unique approach, akin to the majestic flight of eagles, unveils the story of supply and demand in the financial markets.

Phases of EagleVision Cycle:

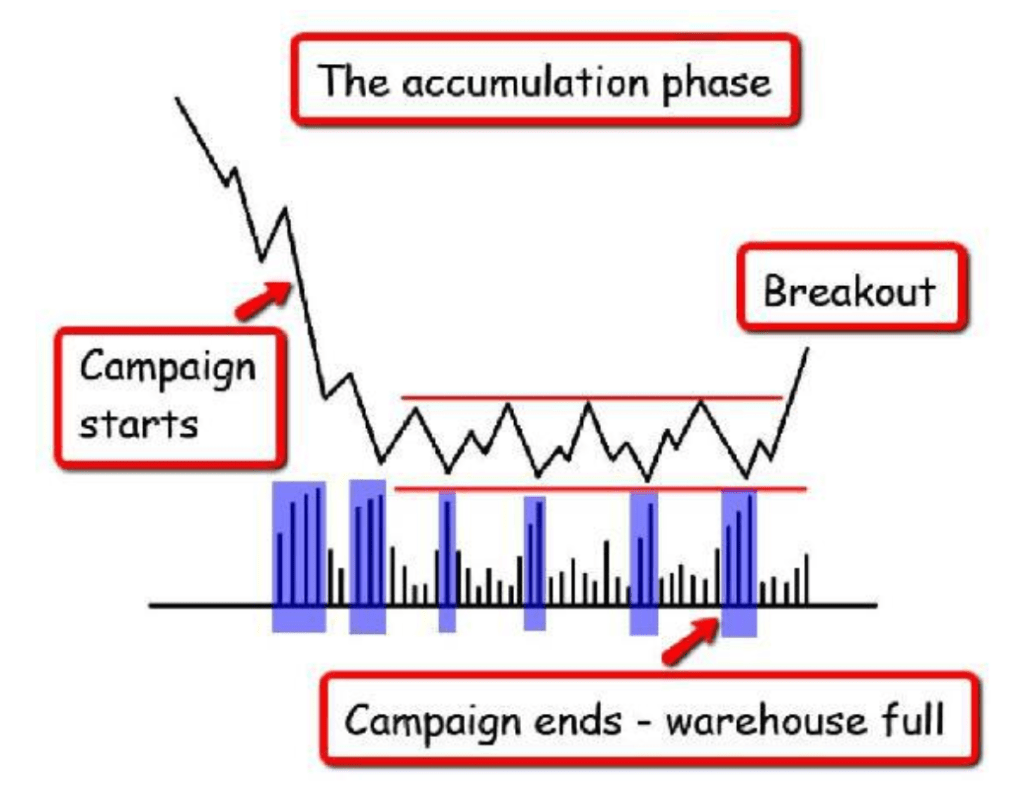

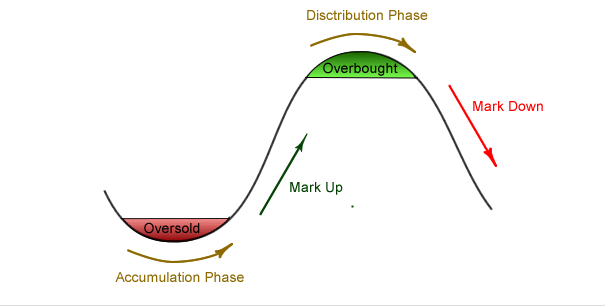

Nesting Phase (Accumulation Phase):

- Description: In this phase, patient investors, like vigilant eagles, strategically build their nests. Prices hover, mirroring a delicate balance between buying and selling pressure.

- Signs: Nesting, reduced market volatility, and a gradual rise in trading volume, much like the silent preparation for flight.

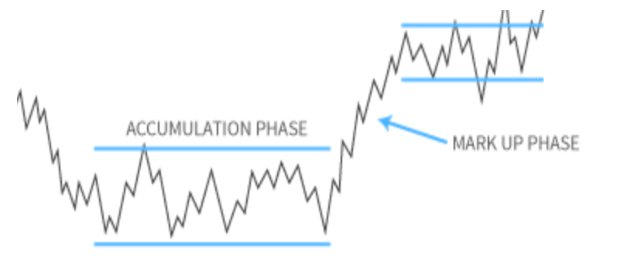

Soaring Uplift Phase (Mark Up):

- Description: Following the nesting, the market takes flight with the soaring uplift phase. Demand, like a powerful updraft, lifts prices into a bullish ascent.

- Signs: Ascending prices, soaring volume, and a robust bullish momentum akin to the eagles riding the thermals.

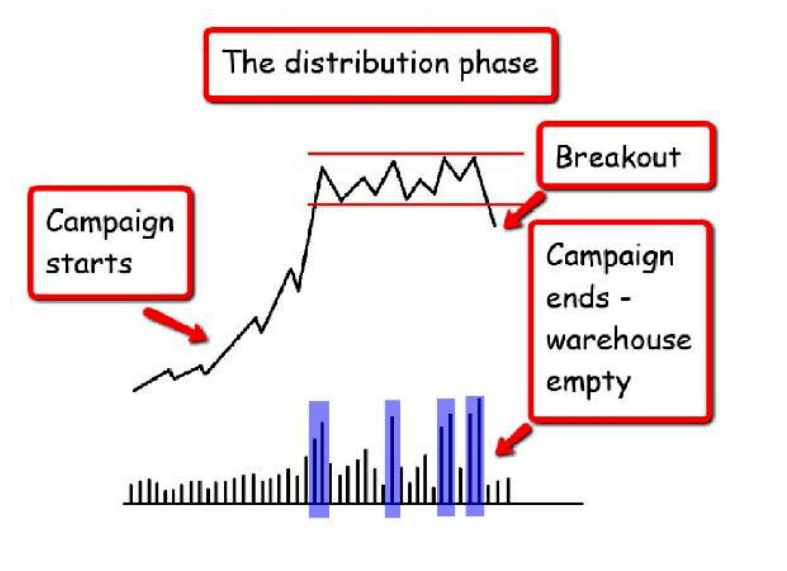

Windward Glide Phase (Distribution phase):

- Description: In this phase, informed investors gracefully glide on the windward currents, gradually releasing their positions. Prices display a sideways or slightly downward drift.

- Signs: Gentle selling pressure, prices holding steady or gently descending, and a rising volume during these periods of descent.

Descending Thermal Phase (Mark Down):

- Description: Similar to eagles riding descending thermals, the market experiences a bearish descent. Prices decline as selling pressure gains momentum.

- Signs: Vigorous downtrend, descending prices, and heightened volume during market sell-offs.

Understanding these phases within EagleVision cycle empowers traders to navigate the market currents with the precision of an eagle in flight. By analyzing volume alongside price movements, traders gain a heightened perspective, much like the elevated vision of eagles, enabling them to spot potential reversals and trade with unwavering confidence. EagleVision Analysis serves as the wingspan for traders, offering insights into market sentiment and the unseen forces steering price action.

Popular Volume Indicators

Several volume indicators help traders gain a deeper understanding of volume patterns and their implications. Here are some widely used volume indicators:

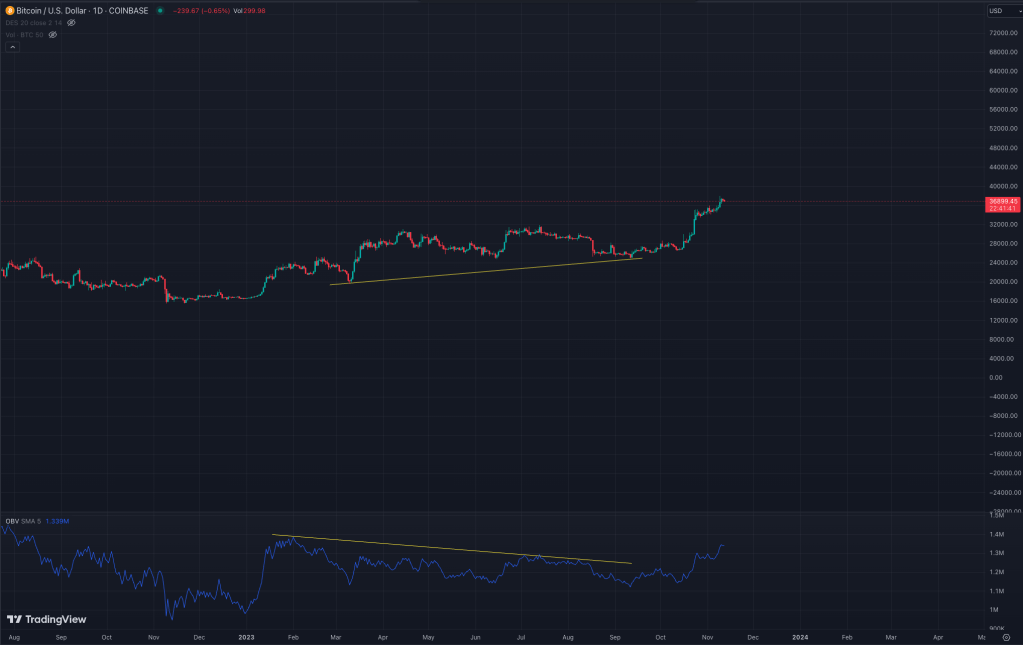

On-Balance Volume (OBV):

OBV is a straightforward volume indicator. It adds up the trading volume when prices close higher and subtracts it when prices close lower. This indicator helps identify the strength of a trend and potential trend reversals.

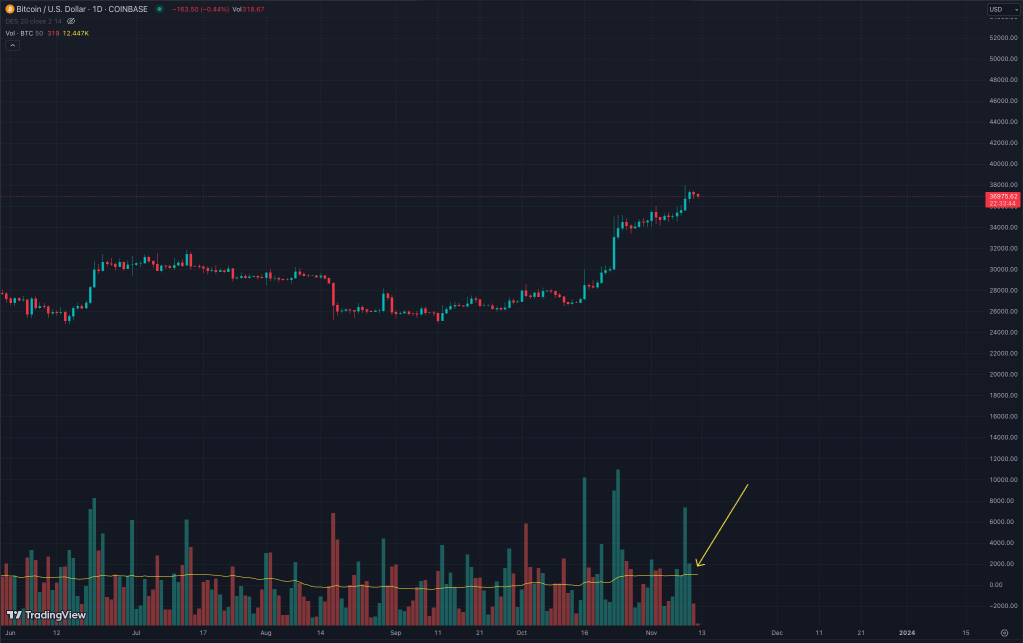

Volume Moving Averages:

Moving averages are used to smooth out volume data, making it easier to identify trends. Common choices include the 50-day and 200-day volume moving averages.

Volume Weighted Average Price (VWAP):

VWAP is a powerful volume-based indicator in the realm of technical analysis, building upon the foundation of trading volume. It’s like the conductor of a symphony, harmonizing trading activity and price levels to provide traders with valuable insights.

VWAP in the World of Volume Analysis

VWAP stands out as a critical volume indicator for several reasons:

- Intraday Benchmark: VWAP serves as a benchmark during the trading day, offering traders a reference point to assess the average price at which an asset has traded. This average is not merely an arithmetic mean; it’s volume-weighted, which means that the prices where most trading occurred carry more weight.

- Market Sentiment Indicator: VWAP is instrumental in gauging market sentiment. Traders compare an asset’s current price to VWAP to determine whether it aligns with the average market price for the day. If the current price is above VWAP, it may indicate bullish sentiment, while prices below VWAP often signify bearish sentiment.

- Reversion to the Mean: VWAP helps traders identify opportunities for mean reversion. When an asset’s price significantly deviates from VWAP, it may suggest an overbought or oversold condition, implying a potential price correction.

- Dynamic Support and Resistance: VWAP can also serve as dynamic intraday support and resistance levels. Prices moving above VWAP are seen as potentially bullish, while prices below VWAP may trigger bearish trading strategies.

- Algorithmic Trading: Many algorithmic and high-frequency trading strategies reference VWAP for order execution. They aim to minimize market impact by trading close to the VWAP, contributing to the indicator’s significance.

Practical Use of VWAP:

Traders utilize VWAP in various ways:

- Intraday Decision-Making: Day traders rely on VWAP to make real-time trading decisions. They might consider buying when an asset is trading above VWAP and selling when it’s below.

- Confirmation of Trends: VWAP is instrumental in confirming whether an asset’s current price aligns with the average trading price for the day. This confirmation can be particularly useful when combined with other technical indicators.

- Volume Analysis: VWAP allows traders to analyze the relationship between trading volume and deviations from VWAP. If an asset experiences unusually high volume along with significant deviations from VWAP, it can signal potential trend reversals or strong market sentiment.

- Portfolio Management: VWAP is used for portfolio rebalancing and the execution of large orders to minimize market impact.

Incorporating VWAP into volume analysis, traders can effectively interpret trading patterns, confirm trends, and optimize their trading strategies. VWAP adds depth to the understanding of trading volume by considering both the prices and the volume at which trades occur, offering valuable insights into intraday market dynamics. It’s akin to using a finely tuned instrument in a symphony to capture and harmonize the diverse notes of trading activity.

Volume in Practical Trading

In practice, traders and investors use these volume indicators in conjunction with price analysis to make informed decisions. For example, if a stock is showing bullish price patterns and high trading volume, it can provide greater confidence in an upward trend.

By combining price analysis with volume analysis and popular volume indicators, traders can better understand the market’s underlying dynamics and anticipate potential price movements. Volume is like the soundtrack to the market’s movie, providing cues and signals to traders about what might happen next.