The Language of Candlesticks

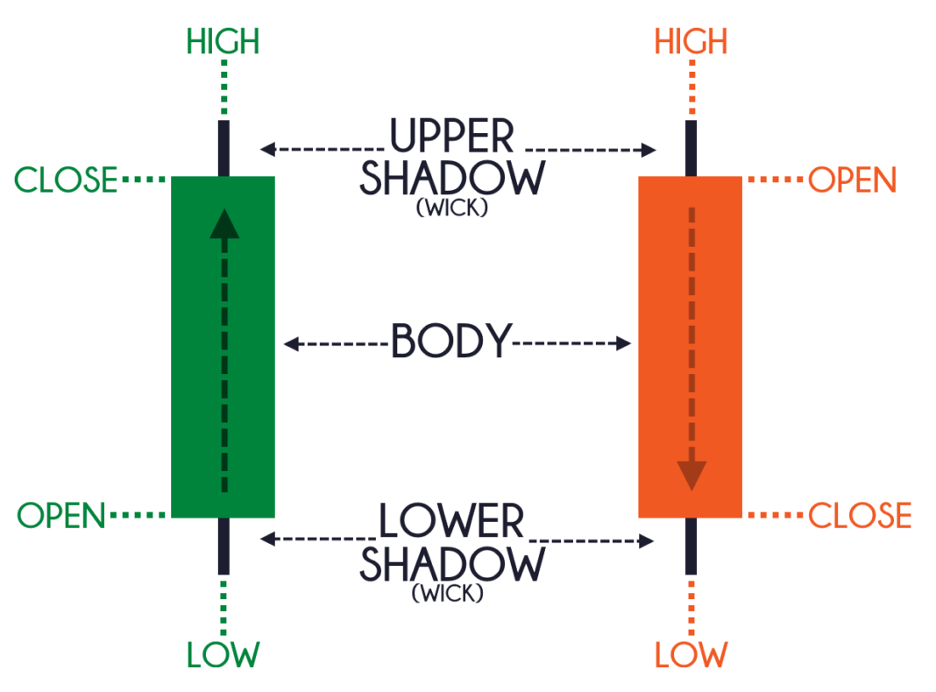

Candlestick patterns are one of the fundamental tools in technical analysis. They are visual representations of price movements in a specific time period and provide traders with valuable information about market sentiment and potential price reversals. To understand candlestick patterns, you must first grasp the basic components of a candlestick:

Open Price: The open price is the price at which an asset starts trading at the beginning of the chosen time period (a day, an hour, or a minute). It is represented by the thin line at the bottom (or top, depending on the candle’s direction) of the candlestick’s “body.”

Close Price: The close price is the price at which the asset ended trading at the end of the selected time period. It is represented by the thin line at the top (or bottom) of the candlestick’s “body.”

High Price: The high price is the highest price reached by the asset during the chosen time period. It is indicated by the top of the candlestick’s “wick” or upper shadow.

Low Price: The low price is the lowest price reached by the asset during the selected time period. It is represented by the bottom of the candlestick’s wick or lower shadow.

Now, let’s explore some common candlestick patterns:

Bullish Candlestick (green): A bullish candlestick is typically green and represents a price increase during the selected time period. In a bullish candlestick:

- The open price is lower than the close price.

- The top of the wick represents the high price.

- The bottom of the wick represents the low price. This pattern suggests that buyers were in control during the specified time frame, driving prices higher.

Bearish Candlestick (red): A bearish candlestick is typically red and represents a price decrease during the selected time period. In a bearish candlestick:

- The open price is higher than the close price.

- The top of the wick represents the high price.

- The bottom of the wick represents the low price. A bearish candlestick indicates that sellers dominated the market during the specified time frame, pushing prices lower.

Bullish vs. Bearish Candlestick Patterns

Now that you understand the basic components of candlesticks, it’s important to differentiate between bullish and bearish candlestick patterns:

Bullish Patterns: Bullish candlestick patterns are formations that suggest a potential price increase. These patterns often indicate a shift from bearish sentiment to bullish sentiment. Some common bullish candlestick patterns include:

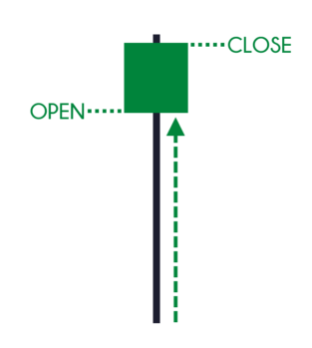

- Hammer: This pattern has a small body with a long lower wick and a short upper wick, resembling a hammer. It signals a potential reversal from a downtrend to an uptrend.

- Bullish Engulfing: In this pattern, a small bearish candle is followed by a larger bullish candle that engulfs the previous one. It suggests a shift in market sentiment from bearish to bullish.

- Morning Star: The morning star pattern consists of three candles: a bearish candle, a small indecisive candle (often called a “doji”), and a bullish candle. It indicates a potential reversal from a downtrend to an uptrend.

Bearish Patterns: Bearish candlestick patterns, on the other hand, suggest a potential price decrease and indicate a shift from bullish sentiment to bearish sentiment. Some common bearish candlestick patterns include:

- Shooting Star: This pattern has a small body with a long upper wick and a short lower wick, resembling a shooting star. It signals a potential reversal from an uptrend to a downtrend.

- Bearish Engulfing: Similar to the bullish engulfing pattern, a bearish engulfing pattern consists of a small bullish candle followed by a larger bearish candle that engulfs the previous one. It suggests a shift from bullish to bearish sentiment.

- Evening Star: The evening star pattern comprises three candles: a bullish candle, a doji, and a bearish candle. It indicates a potential reversal from an uptrend to a downtrend.

Understanding these basic candlestick patterns and their significance is essential for technical analysis, as they can provide valuable insights into market trends and potential trading opportunities.