Support and Resistance Levels

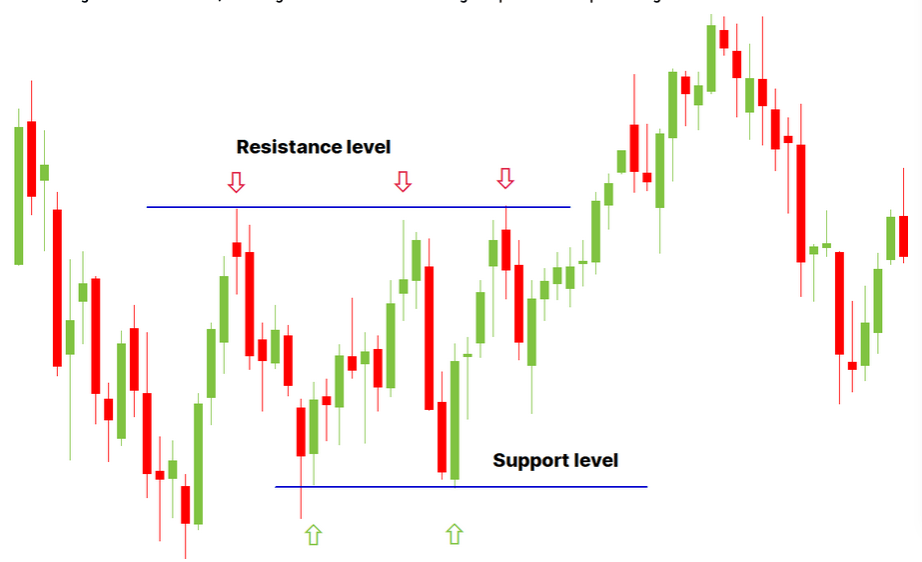

Support and resistance levels are critical concepts in technical analysis. Support represents a price level where an asset tends to find buying interest, preventing it from falling further. Resistance, on the other hand, is a level where selling interest tends to emerge, capping price gains.

let’s dive deeper into the concepts of support and resistance in technical analysis:

Support: A Price Safety Net

Imagine you’re bouncing a ball, and every time it falls, it bounces back up when it hits a certain point. That bouncing point is like a support level in trading. Support is a price level where an asset, like a stock or currency, tends to find buying interest. When prices approach this level, it’s as if there’s a safety net in place, preventing them from falling further.

Traders look at support levels to identify potential buying opportunities. When an asset’s price reaches a support level and shows signs of bouncing back up, it’s often seen as a good time to buy. This is because there’s historical evidence that buyers are willing to step in and push prices higher at that level.

Resistance: The Price Barrier

Now, think of resistance as a barrier or ceiling. It’s like when you’re trying to push a balloon underwater, and it keeps coming back up. Resistance is a price level where selling interest tends to emerge, preventing prices from rising further.

When an asset’s price approaches a resistance level, it faces a challenge. It’s as if there’s a glass ceiling overhead. Traders often see resistance levels as potential selling opportunities. When prices reach a resistance level and start showing signs of moving downward, it’s considered a good time to sell. This is because historical data suggests that sellers tend to dominate and push prices lower at that level.

The Art of Identifying and Using These Levels

Identifying support and resistance levels is both an art and a science. Traders use various tools and techniques to pinpoint these levels on price charts. They look at historical price data and pay attention to where prices have bounced or struggled to break through in the past.

Once identified, support and resistance levels become important reference points for making trading decisions. Traders can set stop-loss orders just below support levels to limit potential losses or take-profit orders just before resistance levels to secure profits.

let’s explore different types of support and resistance levels with examples:

1. Horizontal Support and Resistance:

– Horizontal Support: This occurs when the price of an asset tends to bounce back up from a specific price level. For example, if a stock consistently finds buyers at $50, $50 becomes a horizontal support level.

– Horizontal Resistance: Conversely, horizontal resistance is a level where selling interest tends to cap price gains. If a stock consistently struggles to break above $70, $70 becomes a horizontal resistance level.

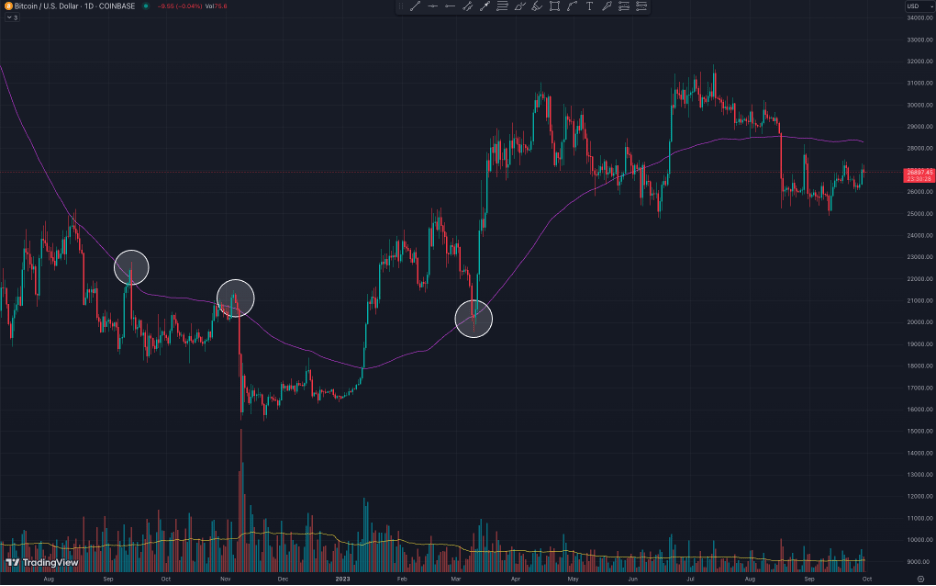

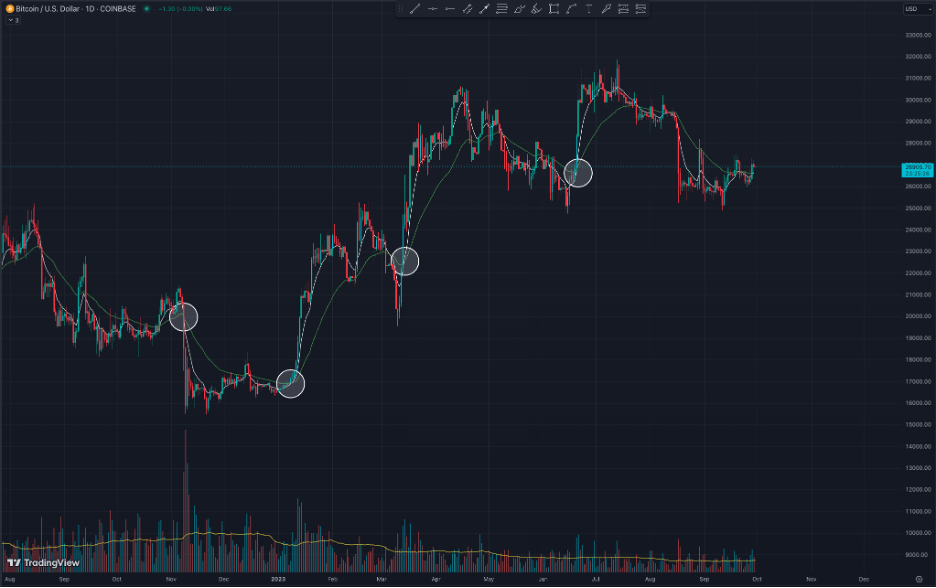

2. Dynamic Support and Resistance:

– Moving Averages: Moving averages are dynamic support and resistance levels that change over time. A simple example is the 50-day moving average. If a stock’s price tends to stay above this average, it acts as dynamic support.

Besides being dynamic support or resistance, moving averages can also act as trend-following indicators. For example, when a short-term moving average crosses above a long-term moving average, it’s seen as a bullish signal, acting as a form of resistance for downtrends.

3. Psychological Support and Resistance:

– Psychological levels: These are round numbers that often serve as psychological support or resistance. For instance, prices often find support at $100 or $500 in stocks and in cryptocurrencies because traders pay attention to these psychologically significant levels.

– All-Time Highs and Lows: The highest price an asset has ever reached (all-time high) or the lowest price (all-time low) can also act as psychological resistance or support levels.

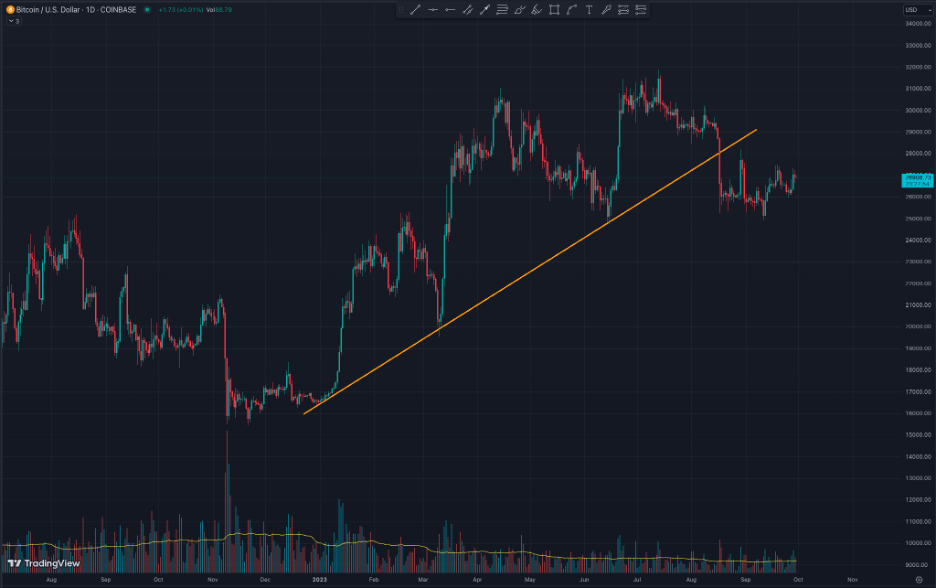

4. Diagonal Support and Resistance:

– Trendlines: Diagonal trendlines, such as ascending (support) and descending (resistance) trendlines, follow the general direction of price movement. For example, an ascending trendline connecting higher lows can act as diagonal support.

5. Fibonacci Retracement Levels:

– These are technical levels derived from the Fibonacci sequence (e.g., 38.2%, 50%, 61.8%). Traders use these levels to identify potential support or resistance points in a price trend.

These are just some of the many types of support and resistance levels that traders use in technical analysis. Each type has its unique characteristics and is employed in different market conditions to make informed trading decisions.

In summary, support and resistance levels are fundamental concepts in technical analysis. Support acts as a price safety net where buying interest emerges, while resistance serves as a barrier where selling interest prevails. Traders use these levels to make informed decisions, manage risk, and identify potential entry and exit points in the ever-evolving world of financial markets.